Current accounts

Make managing your money easy with an HSBC current account. Apply for your account today and take full control of your finances.

Find the right current account for you

What kind of current account are you looking for?

Before you get your current account

Our most popular bank accounts

Easy everyday banking, with access to retail offers and our Regular Saver Account, and no monthly account fee.

You'll need to qualify for an optional arranged overdraft of at least £1,000. Other eligibility criteria and T&Cs apply.

Our premium bank account, with no monthly account fee and access to exclusive rates on savings and borrowing.

You must have an income of £75,000+ and another eligible HSBC product; or have £50,000 in savings or investments with us; or hold and qualify for HSBC Premier in another country or region. Other eligibility criteria and T&Cs apply.

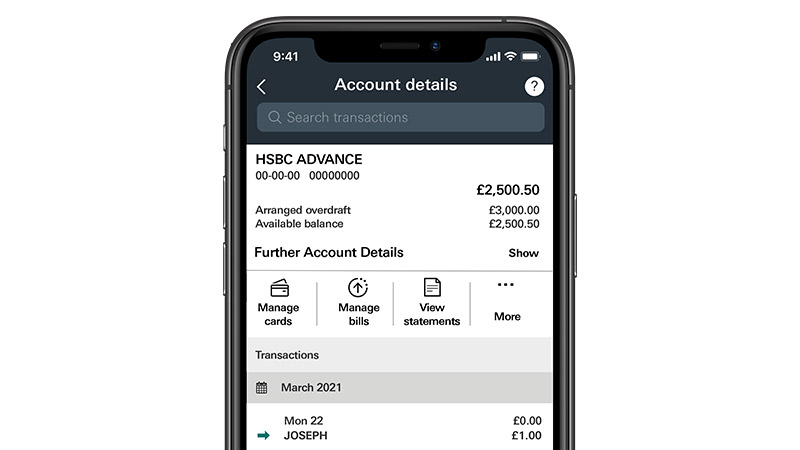

Banking at your fingertips

Make the most of your current account